While some landlords have exited the market due to increased costs and regulation, the same survey found that 11% of landlords, representing 15% of tenancies, are planning to expand their portfolio. This shows that landlords with multiple rentals are still seeing the financial benefits of property investment and recognise opportunities in the market.

According to Zoopla, house prices increased by an average of 21% between March 2020 and August 2022, while flats increased by 9%. Average prices are predicted to fall between 5% and 8% in the coming months, offering opportunities for investors to buy property at below market value. Even if prices fall further in the short term, they are expected to recover in the medium term and be higher in five years.

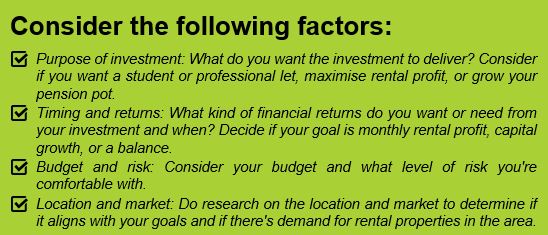

As an investor, it's important to view buy to let as a long-term investment and plan to hold property for at least 15 years to ride out the market's natural peaks and troughs. Creating a buy to let property investment strategy is crucial to weigh the pros and cons and determine if it's the right investment for you.

Creating a buy to let property investment strategy is crucial to weigh the pros and cons and determine if it's the right investment for you.

According to Dechlan Connell, Lettings Manager at First 4 Lettings:

"Investing in buy-to-let properties remains a good opportunity as the demand for rental properties continues to grow. However, you must adhere to private rented sector regulations. I advise landlords to work with a reputable agent like First 4 Lettings to minimise stress, maximise rent and ensure compliance with increasing regulations. You should view your property investment as a business and value your time accordingly."

2023 offers excellent opportunities in the buy-to-let market. Contact us today!

Written by First 4 Lettings